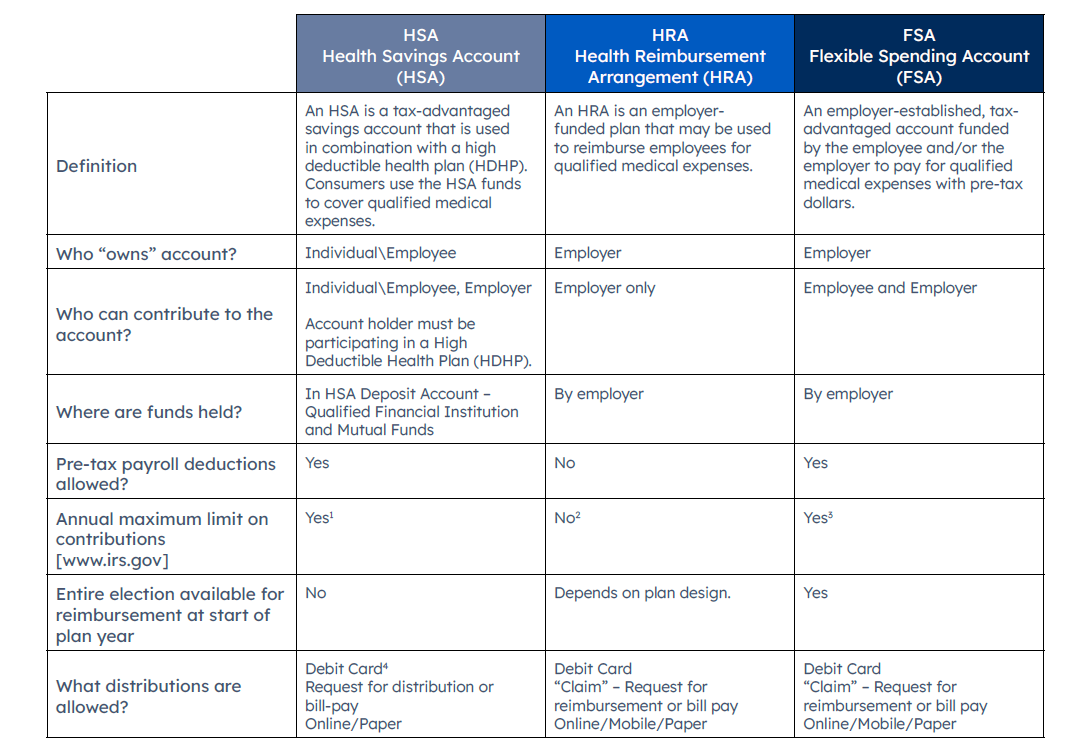

NOTE: This publication is for informational purposes only. The IRS releases limits and maximums throughout each year. Therefore, be sure to check IRS.gov for updates by the IRS after the date of this publication.

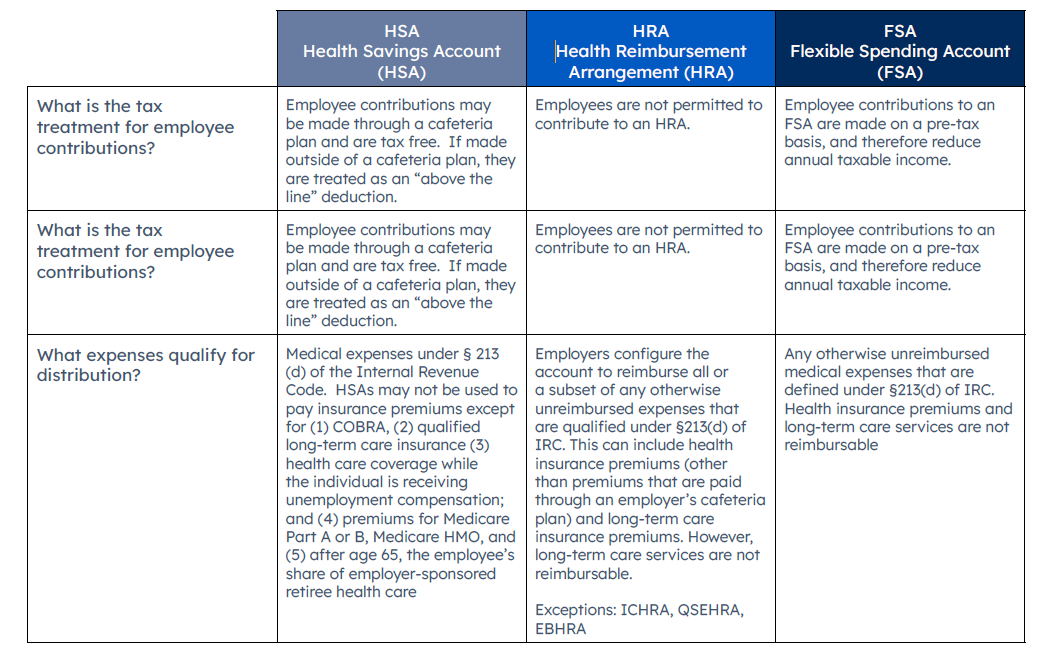

1. IRS-imposed HSA limits for 2021: The 2021 annual HSA contribution limit for individuals with self-only HDHP coverage is $3,600 and the limit for individuals with family HDHP coverage is $7,200. Annual catch-up contributions for those 55 and over: $1,000.

2. IRS does not impose HRA limits; limits are set by employer.

3. Employee contribution limits for 2020 for an FSA cannot exceed $2,750 per IRS Rules. Employer contributions may not discriminate in favor of highly compensated individuals. Healthcare reform limits employer contributions to $500 per year or an arrangement in which employer contributions will not exceed the employee’s contributions, such as a one-to-one match, up to $2,750.

4. HSA, HRA and FSA debit cards are automatically restricted for use with medical service providers and for items purchased at retail that are identified as qualified medical expenses based on electronic inventory control codes.

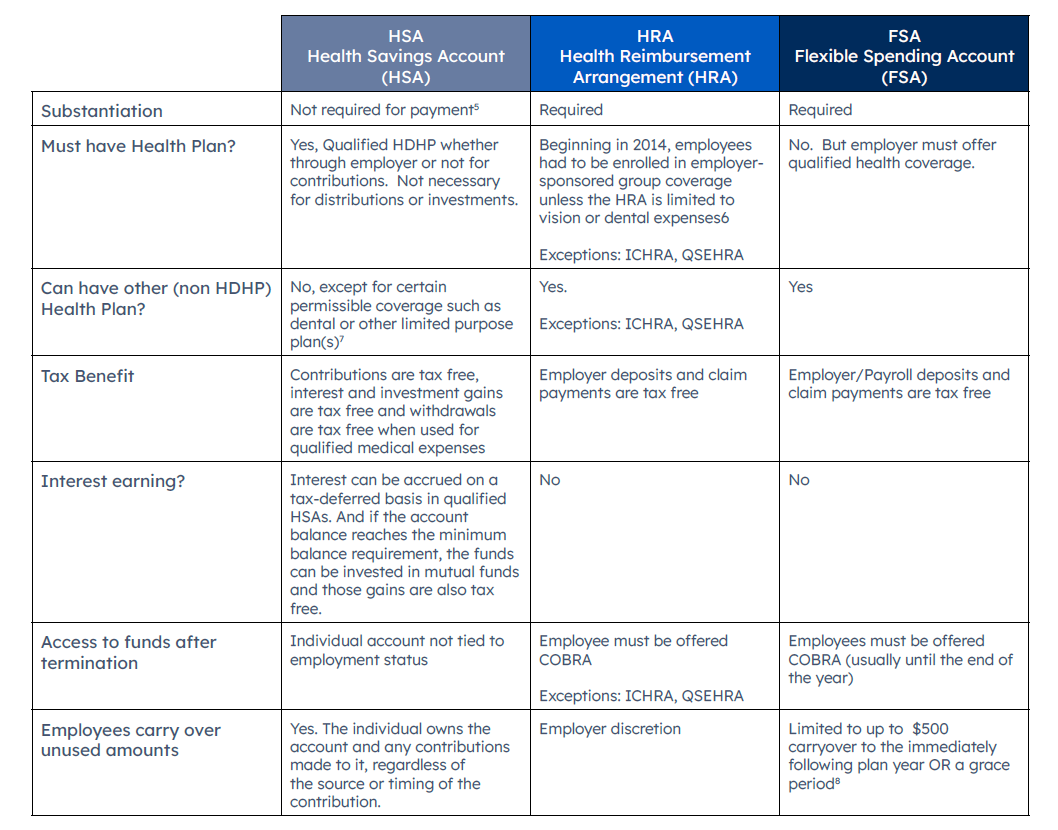

1. HSA distributions subject to IRS audit to prove they do not exceed out-of-pocket qualified medical expenses since HSA opened.

2. PHS Act sec 2711, per DOL FAQ re: PPACA Part XI Q1, Q3 http://www.dol.gov/ebsa/faqs/faq-aca11.html HRA Enrollees must be enrolled in group health plan.

3. Dental, vision, accident, disability, long-term care, workers’ compensation, specified disease or illness and fixed dollar hospitalization, certain deductible plans.

4. Employers may elect to have (i) a “grace” period for employees to use leftover funds from a previous plan year to pay for expenses incurred in the period up to 2 months and 15 days into the new plan year; or (ii) a carryover of up to $500 to the new plan year for payment of medical expenses during the entire year in which it is carried over.

This Plan Comparison Chart is a summary of differences between plan types, and it does not describe all of the rules and limitations that apply to these arrangements. It is not legal or tax advice. See IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, for more information on HSAs, HRAs and FSAs.